ETC Proof of Work Course: 34. Mining ETC

You can listen to or watch this video here:

In the previous class, 33, we explained the meaning of finality with regards to money and decentralized applications (dapps).

We explained the concept of finality in economics and that physical proof of work (POW) finality in blockchains such as Bitcoin (BTC) and Ethereum Classic (ETC) is true and strong.

In this class, 34, we will talk about the activity that produces finality and security in general in POW blockchains such as ETC, which is mining.

We will explain the metrics that make ETC a great business opportunity for cryptocurrency miners around the world.

Mining is the basic native business of proof of work blockchains.

Miners provide computing power in the form of hashrate to blockchains so that each block may be stamped at a very high cost.

These stamps are the only information all nodes and other miners in the system need to know to confirm which is the correct block in each round in a completely decentralized way.

This system has been working uninterruptedly in Bitcoin for 15 years and in Ethereum Classic for 9 years.

The incentives that miners have to put their machines to work for a blockchain such as ETC are the rewards per block.

These rewards are the payments per block in the form of newly created ETC, and the fees of all the transactions included in each block.

The reason you should be mining ETC is for the earnings opportunity that it represents!

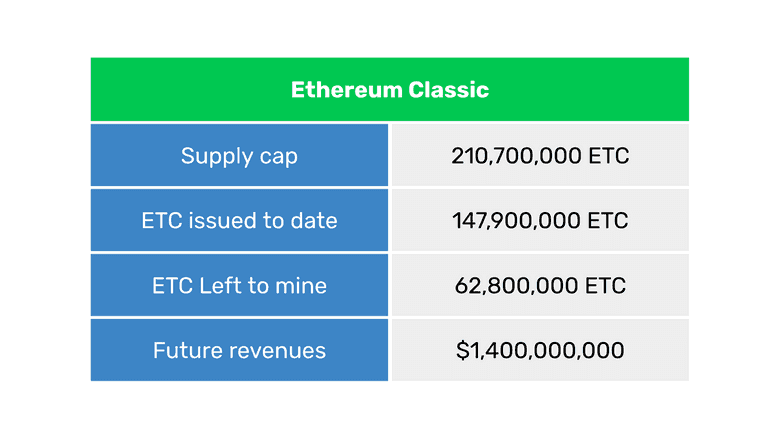

The table in this section shows the four main metrics of ETC mining.

In the next few sections we will explain each one.

ETC Supply Cap

One of Bitcoin’s salient features is that it has a fixed supply that was set since the beginning. The system started paying 50 BTC per block in 2009 and reduced that payment by 50% every 210,000 blocks.

By doing the math, one may calculate that Bitcoin will reach a supply cap of 21,000,000 BTC sometime in the 2130s.

Ethereum Classic adopted a similar monetary policy in 2017. ETC started paying 5 ETC per block and from then on, every 5,000,000 blocks, it is reducing that payment by 20%.

By doing the math, one may calculate that Ethereum Classic will reach a supply cap of 210,700,000 by the same time as Bitcoin.

This supply cap in ETC makes it digital gold, so for miners mining this digital gold is the key of their business.

ETC Issued to date

When Ethereum and Ethereum Classic were one blockchain in 2015, the network was launched with a premine of 72,009,990 coins. This is the initial stock of ETC that was issued before it started.

At the time of this writing, we are on block 20,288,076 and the total supply of ETC is nearly 147.9 million ETC or 147,925,137 ETC to be more precise.

This stock is comprised of the following components:

- Premine: 72,009,990

- Block rewards: 74,389,980

- Uncle blocks: 1,525,167

The uncle blocks are a small portion of the issuance that are paid to miners who, from time to time, make valid blocks at the same time as others but that are not included in the canonical chain.

The ETC issued to date metric is important to figure out the ETC left to mine metric.

ETC Left to Mine

The ETC left to mine metric is the key to miners because it quantifies the total available market for the business!

This is calculated by subtracting the ETC issued to date number to the supply cap number.

If there is a total number of ETC that will ever exist, which is 210.7 million, then if we subtract from that the total stock already issued, which is 147.9 million, we will get the ETC left to mine in the future.

This number is 62,800,000 ETC.

However, the ETC left to mine is not spread evenly over the years until the 2130s. Because of the decreasing monetary policy, around 50% of the ETC left to mine will be paid to miners in the next 10 years. This is a great opportunity!

ETC Future Revenues

If we multiply the ETC left to mine by the price of ETC at the time of this writing we will come up with a figure in dollars of around $1,4 billion.

This means that if nothing changes, miners in ETC will earn $1,400,000,000 of which 50% will be earned in the next 10 years.

However, there are two things that miners must consider with regard to ETC. The first is that it is a blockchain that will likely continue growing, which means that the price of ETC will likely rise and make these revenue estimates pale in comparison.

The second consideration is that miners may accumulate ETC as reserves as they mine it and this will likely constitute a great investment in the future.

Thank you for reading this article!

To learn more about ETC please go to: https://ethereumclassic.org